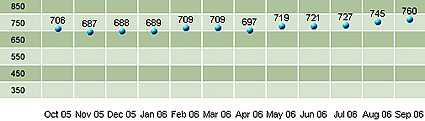

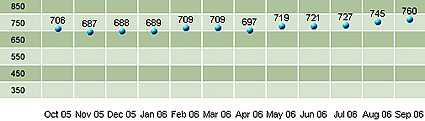

FICO Credit Score Hits 760: Now 40 Points Away From My 2008 Goal

Exciting news: my FICO® credit score recently updated, and is now 760, a new record. I was expecting a bump of around 10 points this month, but I got 15, so I'm quite pleased. My goal is to get to 800 by the fall of 2008, but at my current pace I may be able to pull it off by the end of 2007, or even earlier.

But I also have some bad news to report today. My financial situation is about to take a turn for the worse. My baby girl started preschool recently, and the fees are steep: $134 per week, and that's for a four-day week! The fact that I'm not paying for baby sitting anymore offsets the pain, but it still hurts. Furthermore, my home situation has deteriorated to the point where I will probably be returning to the bachelor life by early next year, and that means no help with the rent and other household bills.

It's a good thing we never married; situation would have been much costlier, in both time and resources, and few things boil my blood more than wasting my time and my resources!

Will I be able to maintain my present standard of living? I think so. I won't be able to put as much as I would into my saving account every month, but I can live with that for a while. I may have to cut back on my credit card payments a bit: instead of paying 3 times the minimum due I may have to cut back to double the minimum, but that's nothing to panic about.

I'm actually quite relieved that my home situation is changing now, because I've made great progress with my debt over the past 2-3 years. Returning to the bachelor life 2 years ago would have been much harder to deal with, no doubt.

I'll cut back on eating out, which means that the owner of my local Chinese restaurant will lose some serious business for a while, but they are always busy (great food and service) so I'm sure the establishment will still be there when I'm ready to return.

Fresh fruit in the morning? Sure, I can still afford it, but I'll have to skip the ripe, precut cantaloupe for a spell (10 times better than coffee as a morning powerbooster, for me anyway.) My local supermarket charges a real premium for paring and slicing the best fruit, so I really should have broken this habit some time ago, especially now that the baby is in preschool and I really should be doing the paring myself. Yup, looks like its back to canned pears for a while.

Living alone will have its advantages. I'll be able to devote a lot more time to work, and the extra productivity will certainly result in more income. Power consumption will be cut in half (I think), so that means a reduced electric bill (it's all electric -- no gas -- where I live.) Of course, there's the reduces stress (<--I won't bore you with those details!) Will I get lonely? I highly doubt it. I'll still be hanging out with my daughter on a regular basis, and I look forward to socializing again -- this will help to add some much needed flavor to my routine. I am very American in that I like to immerse myself in my work, and I am also fortunate in that I very much enjoy what I do, so loneliness and boredom shouldn't be an issue. To put it simply: I accept that change is a normal part of life, and I feel very fortunate that the life modifications I am about to experience probably won't be as traumatic as I've seen in other households (my own parents went through a messy divorce years ago.) I count my blessing each and every day, a habit I recommend to all. As is the tradition with this particular debt blog, I will close with the charted progress of my FICO credit score. I hope to report only good news in next month's blog entry. Thanks for reading.

But I also have some bad news to report today. My financial situation is about to take a turn for the worse. My baby girl started preschool recently, and the fees are steep: $134 per week, and that's for a four-day week! The fact that I'm not paying for baby sitting anymore offsets the pain, but it still hurts. Furthermore, my home situation has deteriorated to the point where I will probably be returning to the bachelor life by early next year, and that means no help with the rent and other household bills.

It's a good thing we never married; situation would have been much costlier, in both time and resources, and few things boil my blood more than wasting my time and my resources!

Will I be able to maintain my present standard of living? I think so. I won't be able to put as much as I would into my saving account every month, but I can live with that for a while. I may have to cut back on my credit card payments a bit: instead of paying 3 times the minimum due I may have to cut back to double the minimum, but that's nothing to panic about.

I'm actually quite relieved that my home situation is changing now, because I've made great progress with my debt over the past 2-3 years. Returning to the bachelor life 2 years ago would have been much harder to deal with, no doubt.

I'll cut back on eating out, which means that the owner of my local Chinese restaurant will lose some serious business for a while, but they are always busy (great food and service) so I'm sure the establishment will still be there when I'm ready to return.

Fresh fruit in the morning? Sure, I can still afford it, but I'll have to skip the ripe, precut cantaloupe for a spell (10 times better than coffee as a morning powerbooster, for me anyway.) My local supermarket charges a real premium for paring and slicing the best fruit, so I really should have broken this habit some time ago, especially now that the baby is in preschool and I really should be doing the paring myself. Yup, looks like its back to canned pears for a while.

Living alone will have its advantages. I'll be able to devote a lot more time to work, and the extra productivity will certainly result in more income. Power consumption will be cut in half (I think), so that means a reduced electric bill (it's all electric -- no gas -- where I live.) Of course, there's the reduces stress (<--I won't bore you with those details!) Will I get lonely? I highly doubt it. I'll still be hanging out with my daughter on a regular basis, and I look forward to socializing again -- this will help to add some much needed flavor to my routine. I am very American in that I like to immerse myself in my work, and I am also fortunate in that I very much enjoy what I do, so loneliness and boredom shouldn't be an issue. To put it simply: I accept that change is a normal part of life, and I feel very fortunate that the life modifications I am about to experience probably won't be as traumatic as I've seen in other households (my own parents went through a messy divorce years ago.) I count my blessing each and every day, a habit I recommend to all. As is the tradition with this particular debt blog, I will close with the charted progress of my FICO credit score. I hope to report only good news in next month's blog entry. Thanks for reading.

Labels: 760, credit_score, fico

|

--> CLICK HERE TO VOTE IN THE DEBT POLL <--

|