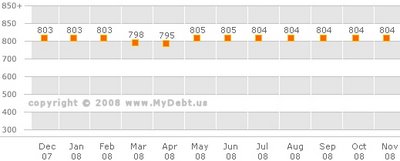

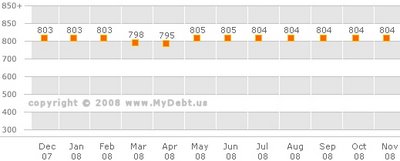

FICO® Credit Score Holds Steady At 804

There are plenty of things I could complain about in my life. My credit score isn't one of them. My FICO® credit score has held steady at 804/805 since May of this year:

I was hanging out in a CNBC forum the other day and came across an interesting thread. The user has a FICO credit score of 788, but is still worried about a comment in his credit report that reads, "amount owed on revolving accounts is too high." I know this comment well. I posted about this back in the summer of 2006 when my credit score hit 719. Yeah, it looks bad, but, in my opinion, that's just the FICO system's way of telling you that if you want to have a score of 800+, pay your revolving accounts down to zero. It's nothing to panic about. This note disappeared from my report when I paid all my personal credit card balances down to zero.

The fact that I still had a balance on one of my business credit cards at the time did not matter, since healthy business credit card debt is reported to business credit rating systems like Dun & Bradstreet's Paydex or Experian's Intelliscore service.

Now, if I ever get into trouble with one of my business credit cards and default (God forbid), the issuing bank(s) will almost certainly report the negative item(s) to all consumer credit monitoring agencies (TransUnion, Equifax and Experian.) They have the right to do this since I signed a personal guarantee when I opened my business credit card accounts, which is standard practice.

Even with my current score of 804, I'm seeing the following notes in my report as reasons why my score isn't higher than 804:

The top one I can understand since I only recently stopped chasing 0% credit card offers. But I find the second note quite funny since I have accounts so old that I'd even forgotten they existed.

Avoiding Interest Charges on My Main Business Credit Card

There is a certain balance on my business credit card that I have been targeting. This target balance allows me to have enough cash to save to for retirement (Roth IRA, of course!), pay my bills and child support, and have a little left over for savings (I wouldn't have a balance at all if the credit crisis never happened, but that's life.) Now, with this particular target balance, finance charges are applied every month. However, I've managed to avoid having to pay any interest by using the rewards points I earn each month to "purchase" a statement credit of $50.

My target balance is $4,000. Since this business card has an APR of 9.99%, the daily periodic rate for purchases is:

How do I manage to stay close to my target balance? Easy! I login to my account at least every other day and check my balance. When my balance is looking too high, I schedule and online payment. Quick and easy. Whenever I make a major purchase, i.e. over $500, I make an online payment immediately, so that I don't mess up my average daily balance.

So, if you've been paying attention, your next question is likely, "so how much do you have to spend each month to get a $50 statement credit?" Easy. A $50 statement credit requires 5,000 rewards points. I get 1 rebate point for each dollar I spend on the card. So I have to spend $5,000 per month. In other words, it's a 1% cash back rewards program.

During the good times, when I'm able to pay my balance to zero every month, my points accumulate and roll over, which gives me plenty to play with during the bad times (I had about 28,500 points stored up when the credit crunch took a serious turn for the worse a couple of months ago. Converted all those points to statement credits.) However, my points do expire if I don't use them within two years, which is quite reasonable in my opinion.

So, with this technique, it would seem as though I could have a 0% business credit card forever, just as long as I keep spending and avoid having an average daily balance above the $4,000 threshold (this card has no annual fee.) But the reality is a "fixed" rate of 9.99% can disappear without much notice. That's because credit card issuing banks invariably reserve the right to modify the terms of each credit card account whenever they wish, as long as they give you warning of an impending rate increase and the option to opt out of it. Citi and American Express have plans to raise APR's for millions of their credit card customers.

This technique requires that I do a lot of spending on this card each month, which has worked out fine since I've been buying a lot of advertising lately. Even as business improves and I'm able to pay down my balance a bit, I have another statement credit tier to work with: I can get a statement credit of $20 in exchange for 2,500 rewards points. As you can see, this tier isn't as equitable as the top tier I described above, but I can still work with it. Maintaining an average daily balance of $2,500 would produce an interest charge of about $21.21, so I'd need to keep my average daily balance at around $2,200 (interest would be $18.67) and spend at least $2,500 per month.

Of course, I'd much rather end this game and return to the good old days of paying my balance in full each and every month. Yes, I'm taking full advantage of my card's rewards program -- and I enjoyed 0% on new purchases and a transferred balance for a year -- which is great. But by having a revolving balance, I'm playing right into the hands of my bank. Bottom line: this scheme could easily blow up in my face if my business has a really bad month.

Some credit cards offer up to 5% cashback on everyday purchases like gas, travel, home improvement, dining out, etc. The Discover More card is the perfect example. For some reason, I wasn't able to get a Discover More card, despite having a good credit score when I applied. When I submitted my application for this card, my FICO score was in the upper 700 range, yet my application was rejected. I checked my credit reports after that rejection, and found nothing wrong. Go figure. If you can get this card, do it. If you already have one, cool. The rewards are peerless in generosity, it comes with 0% intro APR on purchases and balance transfers and the "goto" APR isn't that bad (as low as 10.99%, variable) when compared to competing consumer cards in the American market.

But I'm not complaining. I like my flagship business card. It's a business purpose card, which enables me to have credit card debt and a high personal credit score simultaneously. Plus, the process that my issuing bank has setup for claiming statement credits is efficient and stress free. I just login to my account and within a few clicks of my mouse I've traded my points for a statement credit. Lovely. My other business cards either have APR's that are too high for my taste and credit standing (so I keep them for building credit and emergencies only) or, as is the case with my newest business card, the credit limit is way too low.

Discover has some relatively new business credit cards on the market now, and the rewards are quite generous, though not as generous as the Discover More consumer credit card I noted above. I'd love to apply for this card, but I'm gun shy as a result of my previous rejection.

So, why I am not recommending my favorite business credit card here? Good question. The answer is simple: it's not available anymore. A victim of the current credit crisis. In fact, I just visited the issuing bank's website to see what other business credit cards they have on offer, and found none. The market for business credit card receivables dried up last month (a receivable is any debt owed to a company/corporation that is not paid in full yet.)

Before the onset of autumn this year, my bank could take my $4,000 business credit card balance, bundle it with other credit card receivables and sell the debt to Wall Street. But investors don't want to buy that kind of debt right now because credit card defaults are rising, even with accounts held by prime borrowers.

Want to know when global credit markets will improve? Stay tuned to the TED spread (the TED spread is the difference between the yield on the 3-month Treasury Bill and the 3-month LIBOR yield; it's a reliable indicator of banks' willingness to lend.) Once it falls below 1.00 percentage point, banks will start (probably with baby steps at first) lending like they did before this decade's housing boom.

I was hanging out in a CNBC forum the other day and came across an interesting thread. The user has a FICO credit score of 788, but is still worried about a comment in his credit report that reads, "amount owed on revolving accounts is too high." I know this comment well. I posted about this back in the summer of 2006 when my credit score hit 719. Yeah, it looks bad, but, in my opinion, that's just the FICO system's way of telling you that if you want to have a score of 800+, pay your revolving accounts down to zero. It's nothing to panic about. This note disappeared from my report when I paid all my personal credit card balances down to zero.

The fact that I still had a balance on one of my business credit cards at the time did not matter, since healthy business credit card debt is reported to business credit rating systems like Dun & Bradstreet's Paydex or Experian's Intelliscore service.

Now, if I ever get into trouble with one of my business credit cards and default (God forbid), the issuing bank(s) will almost certainly report the negative item(s) to all consumer credit monitoring agencies (TransUnion, Equifax and Experian.) They have the right to do this since I signed a personal guarantee when I opened my business credit card accounts, which is standard practice.

Even with my current score of 804, I'm seeing the following notes in my report as reasons why my score isn't higher than 804:

- "The time since your most recent account opening is very recent

- The length of time your revolving/charge accounts have been established is too short"

The top one I can understand since I only recently stopped chasing 0% credit card offers. But I find the second note quite funny since I have accounts so old that I'd even forgotten they existed.

Avoiding Interest Charges on My Main Business Credit Card

There is a certain balance on my business credit card that I have been targeting. This target balance allows me to have enough cash to save to for retirement (Roth IRA, of course!), pay my bills and child support, and have a little left over for savings (I wouldn't have a balance at all if the credit crisis never happened, but that's life.) Now, with this particular target balance, finance charges are applied every month. However, I've managed to avoid having to pay any interest by using the rewards points I earn each month to "purchase" a statement credit of $50.

My target balance is $4,000. Since this business card has an APR of 9.99%, the daily periodic rate for purchases is:

- 9.99/365 = 0.02737%

- 0.02737% is the same as 0.0002737

How do I manage to stay close to my target balance? Easy! I login to my account at least every other day and check my balance. When my balance is looking too high, I schedule and online payment. Quick and easy. Whenever I make a major purchase, i.e. over $500, I make an online payment immediately, so that I don't mess up my average daily balance.

So, if you've been paying attention, your next question is likely, "so how much do you have to spend each month to get a $50 statement credit?" Easy. A $50 statement credit requires 5,000 rewards points. I get 1 rebate point for each dollar I spend on the card. So I have to spend $5,000 per month. In other words, it's a 1% cash back rewards program.

During the good times, when I'm able to pay my balance to zero every month, my points accumulate and roll over, which gives me plenty to play with during the bad times (I had about 28,500 points stored up when the credit crunch took a serious turn for the worse a couple of months ago. Converted all those points to statement credits.) However, my points do expire if I don't use them within two years, which is quite reasonable in my opinion.

So, with this technique, it would seem as though I could have a 0% business credit card forever, just as long as I keep spending and avoid having an average daily balance above the $4,000 threshold (this card has no annual fee.) But the reality is a "fixed" rate of 9.99% can disappear without much notice. That's because credit card issuing banks invariably reserve the right to modify the terms of each credit card account whenever they wish, as long as they give you warning of an impending rate increase and the option to opt out of it. Citi and American Express have plans to raise APR's for millions of their credit card customers.

This technique requires that I do a lot of spending on this card each month, which has worked out fine since I've been buying a lot of advertising lately. Even as business improves and I'm able to pay down my balance a bit, I have another statement credit tier to work with: I can get a statement credit of $20 in exchange for 2,500 rewards points. As you can see, this tier isn't as equitable as the top tier I described above, but I can still work with it. Maintaining an average daily balance of $2,500 would produce an interest charge of about $21.21, so I'd need to keep my average daily balance at around $2,200 (interest would be $18.67) and spend at least $2,500 per month.

Of course, I'd much rather end this game and return to the good old days of paying my balance in full each and every month. Yes, I'm taking full advantage of my card's rewards program -- and I enjoyed 0% on new purchases and a transferred balance for a year -- which is great. But by having a revolving balance, I'm playing right into the hands of my bank. Bottom line: this scheme could easily blow up in my face if my business has a really bad month.

Some credit cards offer up to 5% cashback on everyday purchases like gas, travel, home improvement, dining out, etc. The Discover More card is the perfect example. For some reason, I wasn't able to get a Discover More card, despite having a good credit score when I applied. When I submitted my application for this card, my FICO score was in the upper 700 range, yet my application was rejected. I checked my credit reports after that rejection, and found nothing wrong. Go figure. If you can get this card, do it. If you already have one, cool. The rewards are peerless in generosity, it comes with 0% intro APR on purchases and balance transfers and the "goto" APR isn't that bad (as low as 10.99%, variable) when compared to competing consumer cards in the American market.

But I'm not complaining. I like my flagship business card. It's a business purpose card, which enables me to have credit card debt and a high personal credit score simultaneously. Plus, the process that my issuing bank has setup for claiming statement credits is efficient and stress free. I just login to my account and within a few clicks of my mouse I've traded my points for a statement credit. Lovely. My other business cards either have APR's that are too high for my taste and credit standing (so I keep them for building credit and emergencies only) or, as is the case with my newest business card, the credit limit is way too low.

Discover has some relatively new business credit cards on the market now, and the rewards are quite generous, though not as generous as the Discover More consumer credit card I noted above. I'd love to apply for this card, but I'm gun shy as a result of my previous rejection.

So, why I am not recommending my favorite business credit card here? Good question. The answer is simple: it's not available anymore. A victim of the current credit crisis. In fact, I just visited the issuing bank's website to see what other business credit cards they have on offer, and found none. The market for business credit card receivables dried up last month (a receivable is any debt owed to a company/corporation that is not paid in full yet.)

Before the onset of autumn this year, my bank could take my $4,000 business credit card balance, bundle it with other credit card receivables and sell the debt to Wall Street. But investors don't want to buy that kind of debt right now because credit card defaults are rising, even with accounts held by prime borrowers.

Want to know when global credit markets will improve? Stay tuned to the TED spread (the TED spread is the difference between the yield on the 3-month Treasury Bill and the 3-month LIBOR yield; it's a reliable indicator of banks' willingness to lend.) Once it falls below 1.00 percentage point, banks will start (probably with baby steps at first) lending like they did before this decade's housing boom.

Labels: american_express, business_credit_card, citi, credit_card_debt, credit_card_rewards, credit_crunch, credit_score, discover, fair_isaac, fico, ted_spread

|

--> CLICK HERE TO VOTE IN THE DEBT POLL <--

|