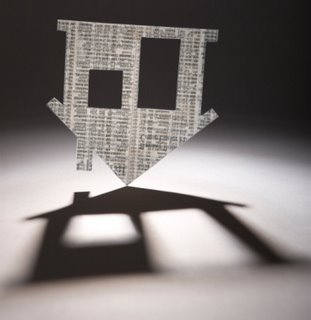

Don't Forget: There Is A 3 Year Moratorium On Tax Liability For Debt Forgiveness

On December 27, 2007, President Bush signed the Mortgage Forgiveness Debt Relief Act[1] of 2007 (HR 3648) into law.

On December 27, 2007, President Bush signed the Mortgage Forgiveness Debt Relief Act[1] of 2007 (HR 3648) into law.This law established a 3 year moratorium that prevents any debt forgiven by a lender from being counted as income by the Internal Revenue Service (IRS). Basically, if a homeowner negotiates a short sale or any other type of debt forgiveness with a lender, the homeowner will not be liable for any taxes on the forgiven debt.

For example, if a homeowner in foreclosure gets a bank to agree to take $400,000 for an original loan amount of $500,000, then the homeowner will not have to pay any taxes on the forgiven $100,000 ($500,000 minus the $400,000).

The Mortgage Debt Relief act also extends the private mortgage insurance deductions through 2010. The deduction for private mortgage insurance allows families with an adjusted gross income of $109,000 or less to deduct all or some of their premium payments.

As it stands, the Mortgage Forgiveness Debt Relief Act only applies to a primary residence. So second homes and investment properties are out. Still, even with a second home or an investment property you may not have to pay any tax on the forgiven debt, so long as you can prove to the IRS that you were insolvent at the time. Which may or may not be tough to do.

With the Mortgage Forgiveness Debt Relief Act of 2007, as long as it’s your primary residence, you don’t have to prove anything to the IRS.

If a short sale is the best option, then this is the time to negotiate one.

Labels: ademola, debt_relief, hr_3648, irs, mortgage, mortgage_debt_relief_act, mortgage_foregiveness, mortgage_relief, short_sale

|

--> CLICK HERE TO VOTE IN THE DEBT POLL <--

|