Hey, Student Loan: Bye-Bye, and Thanks for The Memories

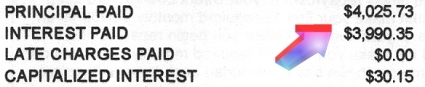

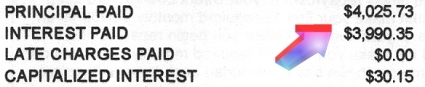

My student loan statement for 2007 arrived from the U.S. Department of Education (ED) earlier today. As I reviewed the numbers, I reached a section of the document that actually made me somewhat sick to my stomach. Here it is:

The sickening part, you ask? Since I began repaying this loan, I've paid nearly as much money in interest as I have on the principal. That's enough to make anyone queasy. This truth didn't bother me too much in the past, but it does now. A lot. I'm just too old to be paying this kinda' interest. For 2007, I paid close to $650 in interest on my student loan debt.

This situation is my fault really. When I started repaying this loan, I wasn't making that much money, so I wanted the installment amount to be a low as possible. Thankfully, the good folks at William D. Ford have an "income contingent" repayment option which allows the borrower to set their monthly payment amount to a figure that's commensurate with their salary. My payment was set to $109.11 per month, which has been very manageable over the years, especially with the added tax deduction. Income contingent is great for your budget in the short term, but devastating for your finances in the long. Paying such a small amount each month is a great way to get nowhere fast. I should have gotten off income contingent a while ago.

I thought about contacting ED to get myself off the income contingent plan and onto a plan more compatible with my current financial status. I thought about this for a while and eventually came to the conclusion that this option wouldn't give me any real satisfaction. I realized that the only way I was going to feel like I've improved my financial life would be to get rid of my student loan debt as fast as possible.

My next idea was to take advantage of one of the 0% balance transfer checks that I often receive via snail mail, offers from credit card companies with which I already have an account. In fact, today I got one from Bank of America, and it fit the bill nicely. The balance on my student loan debt is a little over $11,500 (I called for a payoff quote), and this particular Bank of America account has a credit limit that's close to $13,000. All I would have had to do was sign the check, mail it to ED, and the debt would have been transferred to my card. I would have paid no interest on the debt until January 2009. I wouldn't have waited that long to pay it down to zero, however; I would have paid the card off within 4 to 5 months.

My next idea was to take advantage of one of the 0% balance transfer checks that I often receive via snail mail, offers from credit card companies with which I already have an account. In fact, today I got one from Bank of America, and it fit the bill nicely. The balance on my student loan debt is a little over $11,500 (I called for a payoff quote), and this particular Bank of America account has a credit limit that's close to $13,000. All I would have had to do was sign the check, mail it to ED, and the debt would have been transferred to my card. I would have paid no interest on the debt until January 2009. I wouldn't have waited that long to pay it down to zero, however; I would have paid the card off within 4 to 5 months.

This idea soured real fast when I realized that my credit score would have taken a pretty big hit as a result of this debt transfer maneuver, especially because this card would have been close to "maxed out" for a while.

I then decided to just payoff the debt with good old fashioned cash, a decision I'm going to stick with. In a few minutes, I'm going to make arrangements with my bank to transfer the cash, and, in about 12 days or so, the cancer that is my student loan debt will be expunged from my life forever.

The decision to pay cash wasn't an easy one. Very recently, I dipped into my puny savings account to payoff my car note, so another incursion into my savings account is going to leave me with a very wimpy emergency fund. The prospect of being 100% free from paying interest, however, is just too tantalizing for me to resist, so I'm doing it. I'll have to tighten my belt for some months, but that's OK, for I've learned to love the idea of making small sacrifices in order to realize "big picture" goals.

The sickening part, you ask? Since I began repaying this loan, I've paid nearly as much money in interest as I have on the principal. That's enough to make anyone queasy. This truth didn't bother me too much in the past, but it does now. A lot. I'm just too old to be paying this kinda' interest. For 2007, I paid close to $650 in interest on my student loan debt.

This situation is my fault really. When I started repaying this loan, I wasn't making that much money, so I wanted the installment amount to be a low as possible. Thankfully, the good folks at William D. Ford have an "income contingent" repayment option which allows the borrower to set their monthly payment amount to a figure that's commensurate with their salary. My payment was set to $109.11 per month, which has been very manageable over the years, especially with the added tax deduction. Income contingent is great for your budget in the short term, but devastating for your finances in the long. Paying such a small amount each month is a great way to get nowhere fast. I should have gotten off income contingent a while ago.

I thought about contacting ED to get myself off the income contingent plan and onto a plan more compatible with my current financial status. I thought about this for a while and eventually came to the conclusion that this option wouldn't give me any real satisfaction. I realized that the only way I was going to feel like I've improved my financial life would be to get rid of my student loan debt as fast as possible.

My next idea was to take advantage of one of the 0% balance transfer checks that I often receive via snail mail, offers from credit card companies with which I already have an account. In fact, today I got one from Bank of America, and it fit the bill nicely. The balance on my student loan debt is a little over $11,500 (I called for a payoff quote), and this particular Bank of America account has a credit limit that's close to $13,000. All I would have had to do was sign the check, mail it to ED, and the debt would have been transferred to my card. I would have paid no interest on the debt until January 2009. I wouldn't have waited that long to pay it down to zero, however; I would have paid the card off within 4 to 5 months.

My next idea was to take advantage of one of the 0% balance transfer checks that I often receive via snail mail, offers from credit card companies with which I already have an account. In fact, today I got one from Bank of America, and it fit the bill nicely. The balance on my student loan debt is a little over $11,500 (I called for a payoff quote), and this particular Bank of America account has a credit limit that's close to $13,000. All I would have had to do was sign the check, mail it to ED, and the debt would have been transferred to my card. I would have paid no interest on the debt until January 2009. I wouldn't have waited that long to pay it down to zero, however; I would have paid the card off within 4 to 5 months.This idea soured real fast when I realized that my credit score would have taken a pretty big hit as a result of this debt transfer maneuver, especially because this card would have been close to "maxed out" for a while.

I then decided to just payoff the debt with good old fashioned cash, a decision I'm going to stick with. In a few minutes, I'm going to make arrangements with my bank to transfer the cash, and, in about 12 days or so, the cancer that is my student loan debt will be expunged from my life forever.

The decision to pay cash wasn't an easy one. Very recently, I dipped into my puny savings account to payoff my car note, so another incursion into my savings account is going to leave me with a very wimpy emergency fund. The prospect of being 100% free from paying interest, however, is just too tantalizing for me to resist, so I'm doing it. I'll have to tighten my belt for some months, but that's OK, for I've learned to love the idea of making small sacrifices in order to realize "big picture" goals.

Labels: student_loan_debt

|

--> CLICK HERE TO VOTE IN THE DEBT POLL <--

|

1 Comments:

Congratulations on finally getting that debt paid off!

This post is full of pertinent information for all of us who are still paying off student loans.

You are the go-to guy on this subject!

Post a Comment

Links to this post:

Create a Link

<< Home