I admit: I was a bit spoiled when I was young. Up until my late teen years, I never had to do my own laundry. Even when I was an adolescent and sent off to boarding school, they had folks to take care of that stuff.

Doing laundry in college wasn't so bad, since the machines were never too far away, and I always had the option of letting it pile up then take it home for washing.

In my twenties, I started living on my own, and then laundry became a real pain in the neck. I moved quite a bit, and I never lived close to a laundromat. I would have to fill up huge sacks and lug my clothes, along with detergent, a few city blocks to get to the machines (I didn't own a car back then.) I would then have to pay up to $7 per load to get the job done. I hated it. It was a waste of time, energy and money.

In my early thirties, I ended up living in a house where the owner had a washing machine, but no dryer. I would hang my clothes to dry, and that got on my nerves eventually.

Now that I'm pushing forty, I have absolutely no tolerance for doing laundry in an inefficient way. Many of my friends who live in big cities send their laundry out, which I think is the right thing to do if you have the money and don't have the time and energy for it. But, since adulthood, I've never been comfortable with the idea of having someone else wash my clothes, even though I'd be paying for the service. I feel that dirty laundry is a very personal thing.

When I was living with the mother of my child, she handled the laundry. I paid for everything, and she handled the leg work. Eventually the loads got so big (with all the baby clothes) that she started to complain that the laundry duties were breaking her back and taking up too much of her time. I empathized, and told her that I would buy a washer and dryer for the apartment, even if I had to use a credit card. At that point, all she had to do was clear out the lower level closet which has the laundry hookups; she was using this closet to store old shoes, clothes and things I couldn't even identify.

She never cleared the closet.

On my own again, I realized that I had to buy a washer and dryer, and fast. At this point in my life, putting thousands of dollars on a credit card is simply unacceptable, so I saved up for a few months, then went shopping for a new washer and dryer in my area.

I tried Circuit City, Lowe's, Home Depot and Best Buy. The prices, selection and customer service were best at Best Buy, so I decided to make my purchase there. After poking around and asking lots of questions, I decided on the LG TROMM WM2487H 4.0 cu. ft. front load washer, and the LG TROMM LG DLE7177RM 7.3 cu. ft. matching electric dryer. For those of you who are interested, here is my review.

I paid $1,143.99 for the washer, and $999.99 for the dryer.

First, these machines are very handsome. They are perfectly matched in color, size and form, and they are stackable (the stackable feature is very important to me since my laundry closet is quite narrow.) The Best Buy delivery guys did a great job installing the machines; the installation was challenging due to the tight closet. When stacked, the two machines just barely fit inside my closet vertically, which was a huge relief. But the front ends of the machines extended out beyond the closet door. My solution: I just removed the closet door, which was very easy. These babies are so pretty that I probably wouldn't have closed the closet door anyway.

The washer has a huge capacity, which is important to me since I need to wash comforters and such. Even after stuffing one of my queen-sized comforters in the washer, I still have room for a sheet or two. The dryer can handle two queen-sized comforters easily. I know because I've done it.

These washers use very little water, which is perfect for me because the plumbing system in this place can't handle the large volume of water that most top loading washing machines use. Less water also means less energy used per load, which saves on my electric bill.

The washer removes easy stains, but it's not as good as a top loader at removing tough stains when using a regular cycle. You can, however, use the a special "stain cycle" button for loads with stubborn stains; this feature simply adds more time to the wash, and it works.

The washer easily removes all types of odors. The steam feature is great and I use it for all my loads. The superheated steam really penetrates the clothes, which is evidenced by the way the clothes smell when the wash is done.

Another advantage of front-loading washers is that they are much easier on your clothes, so your clothes will last much longer. The top loader at my parents house used to be so rough on my clothes that my t-shirts -- or anything else made from thin cotton -- would last 5 months, tops.

If wash times are a concern then this LG front loader may turn you off. Most of my loads take an hour and forty-four minutes to finish. The "delay wash" feature can help; it's a feature that lets you set the wash to start up to 19 hours in the future. So if you know you'll be getting up at 9 a.m. on a Saturday morning, you can set the machine (on Friday night) to start the wash at 7 a.m. the next morning. Wake up and the wash is done.

One of the main selling points of this particular washer is the steam feature. When I first started using the machine, I thought the steam feature was bogus, because I would put my face right up to the plastic outer window (don't worry, the inner window is heavy glass) and I couldn't see any steam at any point during the wash. So I set the washer on a steam cycle, added a typical load, then started a wash. I then paused the machine in mid-cycle. When I opened the washer door, a huge cloud of steam came out, and the steam was

extremely hot! I almost burned myself. No need to worry about getting a sanitary load when you use the steam feature.

Both the washer and the dryer have a child lock feature which works great. My daughter, who is smart enough to figure these things out, wasn't able to get the washer door open or mess up the wash by playing with the many controls. (I spied on her when she made an attempt. I tricked her into thinking I was in the shower. Heh.)

You can set the washer to spin super fast after the rinse cycle, which is great because the clothes come out of the washer with most of the water extracted. This translates to less time in the dryer, which in turn saves on the electric bill. When the spin is set to extra-high, the machine puts on quite a show. It's like watching a Navy jet take off from an aircraft carrier. The speed is pretty intense. My daughter gets a real kick out of it, so I guess it's not a guy thing.

The door on washer is not reversible, but the dryer door is. The washer has an internal heater so you don't have to worry about water temperatures. Also, the washer drum is tilted by 10 degrees which makes loading and unloading easier.

The dryer includes a hard, plastic rack which you can use for drying anything from sneakers to delicate sweaters. The rack gives you the power to dry just about anything that can fit in the machine. There's also a "wrinkle care" feature with the dryer. When wrinkle care is selected, the dryer turns on intermittently after the cycle ends, to prevent the clothes from getting wrinkled. I use this feature all the time.

Finally, I've read a few reviews over @

epinions.com. Some folks have complained about a horrible mold smell from the washer. I haven't experienced this. The way I see it, their problem is one or more of the following:

- They used regular detergent instead of high-efficiency (HE) detergent (need to use HE detergent only in these new front loaders.) Regular detergents will cause excess sudsing in the washer (like when you put regular dish detergent into a dishwasher), and this will cause water to get into places where it doesn't belong. Also, standard detergent may contain nutrients that fungi can feed on.

- They do not give the washer a chance to air out when done washing. The instructions indicate that you should leave the door open for a while after each load, to air out the machine, which I do. I also leave the detergent compartment open for a while, since I noticed that some water tends to get left in there after each wash.

- They leave soaking wet loads in the washer for days before removing them from the washer. Fungi just love that. You probably think I'm exaggerating, but I'm not. People do this.

- They have the washer located in a damp, poorly ventilated basement, which is the perfect breeding ground for mold (FYI: mold is a fungus.)

Read

this review and you'll see what I mean. Those who get lazy and/or don't read the instruction manual will certainly have problems with the washer. Those who do the right thing -- like me -- are very, very happy with it. I recommend both the washer and the matching electric dryer to anyone in the market for new washing appliances. I can also recommend Best Buy as an appliance retailer. Your questions and comments are welcome.

Labels: shopping

First, these machines are very handsome. They are perfectly matched in color, size and form, and they are stackable (the stackable feature is very important to me since my laundry closet is quite narrow.) The Best Buy delivery guys did a great job installing the machines; the installation was challenging due to the tight closet. When stacked, the two machines just barely fit inside my closet vertically, which was a huge relief. But the front ends of the machines extended out beyond the closet door. My solution: I just removed the closet door, which was very easy. These babies are so pretty that I probably wouldn't have closed the closet door anyway.

First, these machines are very handsome. They are perfectly matched in color, size and form, and they are stackable (the stackable feature is very important to me since my laundry closet is quite narrow.) The Best Buy delivery guys did a great job installing the machines; the installation was challenging due to the tight closet. When stacked, the two machines just barely fit inside my closet vertically, which was a huge relief. But the front ends of the machines extended out beyond the closet door. My solution: I just removed the closet door, which was very easy. These babies are so pretty that I probably wouldn't have closed the closet door anyway. These washers use very little water, which is perfect for me because the plumbing system in this place can't handle the large volume of water that most top loading washing machines use. Less water also means less energy used per load, which saves on my electric bill.

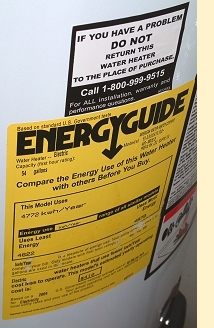

These washers use very little water, which is perfect for me because the plumbing system in this place can't handle the large volume of water that most top loading washing machines use. Less water also means less energy used per load, which saves on my electric bill. I went to take a shower this morning, and found that I had no hot water. For me, taking a cold shower is tantamount to torture, so I immediately called the management for help. The maintenance manager, Don, was at my door within 20 minutes. He checked my water heater and found it dead, which was surprising because it was less than 5 year old. There was water all over the heater and on the floor, so it was a corrosion issue. He told me that I could wait until the next day for a new heater, or he could install one right now, but I would be without water -- both hot and cold -- for about 6 hours (it takes a while to drain a water heater, and for my place you have to shut down the entire plumbing system in order to get the job done.)

I went to take a shower this morning, and found that I had no hot water. For me, taking a cold shower is tantamount to torture, so I immediately called the management for help. The maintenance manager, Don, was at my door within 20 minutes. He checked my water heater and found it dead, which was surprising because it was less than 5 year old. There was water all over the heater and on the floor, so it was a corrosion issue. He told me that I could wait until the next day for a new heater, or he could install one right now, but I would be without water -- both hot and cold -- for about 6 hours (it takes a while to drain a water heater, and for my place you have to shut down the entire plumbing system in order to get the job done.)